Mortgage calculator interest rate change

Try a different interest rate. To figure out your interest-only payments simply follow this formula.

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

How much money could you save.

. Ask your lender about 10- or 20-year fixed-term options or adjustable-rate mortgage ARM programs. In other words the longer the loan term the greater the risk that inflation andor changes in interest rates will reduce the value of that loan. Youll see a change show up in.

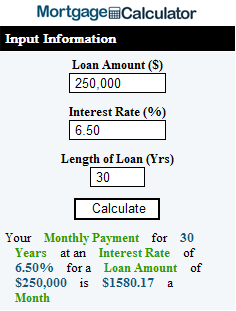

Lock-in Redmonds Low 30-Year Mortgage Rates Today. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. The actual amount you pay depends on several factors including the assessed value of your.

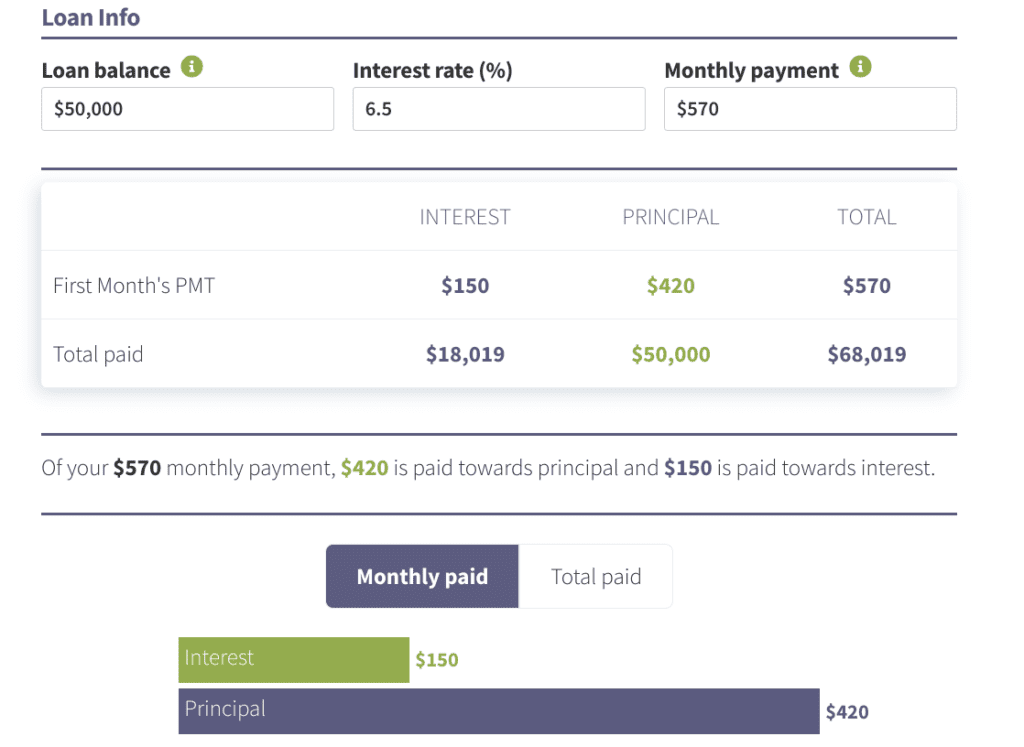

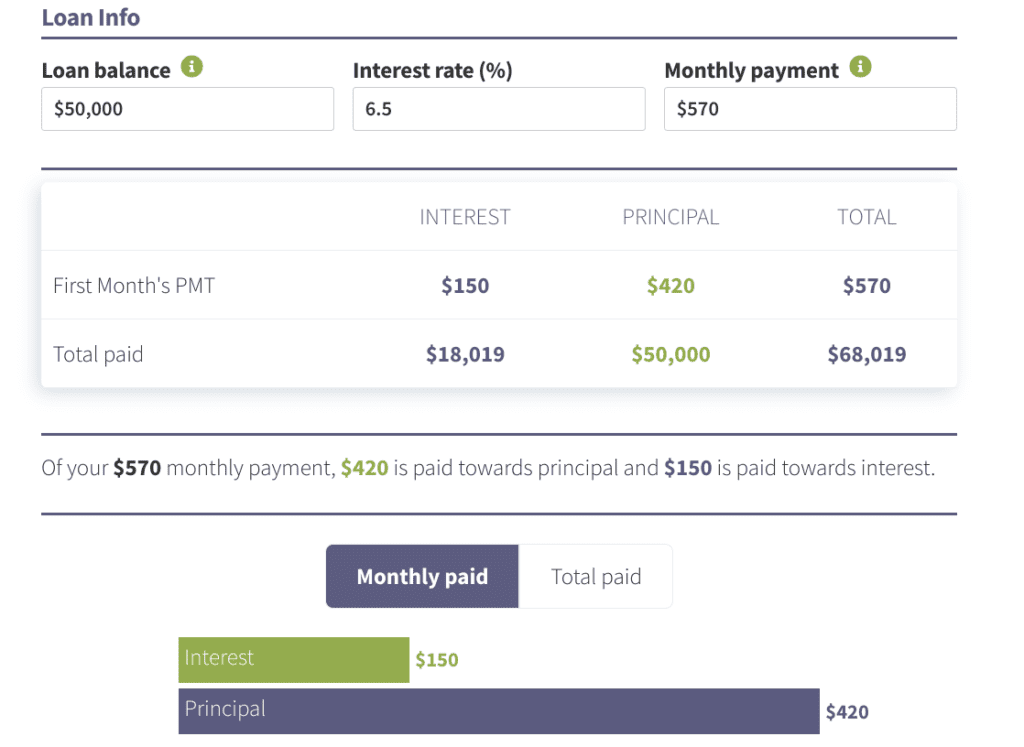

A simple 10 difference in interest rateor even 05can result in you paying thousands of more dollars in interest over the life of the loan. Property taxes may change yearly. Add these values into the calculator fields and press tab or click the Calculate button.

Its recommended that you test out scenarios on our home mortgage calculator to see how interest rate changes as you shift back and forth between different loan terms. Your rough mortgage interest rate estimate. Click the blue Add result to compare button.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Mortgage interest rate calculator. This compensates the lender for what is known as duration risk.

Use Investopedias mortgage calculator to see how different inputs for the home price down payment loan terms and interest rate would change your monthly payment. For example A 30 year mortgage will require a higher interest rate than a comparable 15 year mortgage. A 15-year fixed rate mortgage on the other hand may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed.

Check out the webs best free mortgage calculator to save money on your home loan today. By default 250000 30-yr fixed-rate loans are displayed in the table below. The ability for United States home buyers to obtain a fixed rate for 30 years is rather.

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. You can check todays mortgage rates on our website. Enter your home price down payment interest rate taxes and insurance to get your estimate.

Generally this is best used if you know youll be in the home for less than 7 years because the interest rate could go up after those 7 years. On the other hand variable-rate mortgages have a mortgage interest rate that can change. If you want to use it as an interest only mortgage calculator select the interest only option for mortgage type.

They quote you an annual interest rate but you can figure out the monthly rate by dividing the annual rate by 12. Thats not the case with an adjustable-rate interest-only mortgage where your rate may change after the interest-only period ends. A mortgage calculator helps prospective home loan borrowers figure out what their monthly mortgage payment will be.

Includes mortgage loan payment calculator refinance mortgage rate refinance news and calculator and mortgage lender directory. Based on what you told us. With a variable interest rate mortgage the interest rate will change when the TD Mortgage Prime Rate changes.

Loan Estimate Federal law requires mortgage lenders to show you a three-page Loan. While the monthly mortgage payment for a. The results will display on the screen.

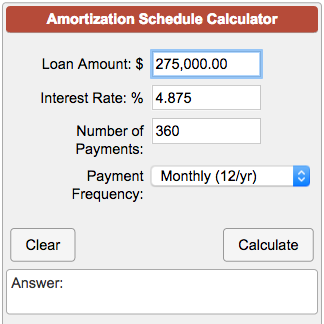

A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each month in total on your home loan. Which can change from year to year. This behaviour can change depending on your mortgage type.

See how a change of interest rates would affect your monthly payments. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Use the Mortgage Payment Calculator to discover the estimated amount of your monthly mortgage payments based on the mortgage option you choose.

A few things are worth noting about the PITI calculations included in our mortgage calculator. This means that the portion of your payment that goes toward the principal may rise or. Advertised rates and APR effective as of 51721 and are subject to change without.

Given that ARM loans are variable the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. 71 ARM - ARM stands for an adjustable-rate mortgage which means your interest rate can fluctuate after 7 years. Your principal will be paid off at an increasingly faster rate as your term progresses.

Toggle Global Navigation Mortgage Personal Loan. Filters enable you to change the loan amount duration or loan type. 51 ARM - Similar to the 71 ARM but the interest rate can change after 5 years.

Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. If you have a repayment mortgage select repayment mortgage for the mortgage type then hit calculate and well do the hard work for you to find out how much your monthly repayments are likely to change. The tax authorities in your area.

For simplicitys sake use the same 200000 loan amount and 30-year fixed-rate mortgage -- but change the interest rate to 4. Compare the latest rates loans payments and fees for ARM and fixed-rate mortgages. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

Your mortgage interest paid over the life of your loan is based on your loan term and your mortgage interest rate. As you pay your principal balance down youll pay less interest. See how changes affect your monthly payment.

The interest rate is the fee the lender charges monthly until you pay the loan in full. Which means the interest rate can change over time. Use this mortgage calculator to estimate your monthly mortgage payment.

Principal and interest calculations are only for 30- and 15-year fixed-rate terms. Fixed-rate mortgages have an interest rate that does not change. Find low home loan mortgage interest rates from hundreds of mortgage companies.

Looking for an interest-only mortgage calculator.

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

True Mortgage Apr Calculator Actual Interest Rate Home Loan Calculator

Mortgage Calculator How Much Monthly Payments Will Cost

Excel Formula Estimate Mortgage Payment Exceljet

Student Loan Interest Calculator Student Loan Planner

Free Interest Only Loan Calculator For Excel

Mortgage Repayment Calculator

Advanced Loan Calculator

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Va Mortgage Calculator Calculate Va Loan Payments

Amortization Schedule Calculator

Mortgage Calculator Script Free Mortgage Calculator Widget

Mortgage Rates Are Expected To Rise But You Ll Still Be Paying Historically Low Rat Mortgage Interest Rates Mortgage Amortization Calculator Mortgage Interest

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Discount Points Calculator How To Calculate Mortgage Points