23+ How much i can mortgage

33-0000 Protective Service Occupations. And how the VA home loan helped them realize the dream of homeownership.

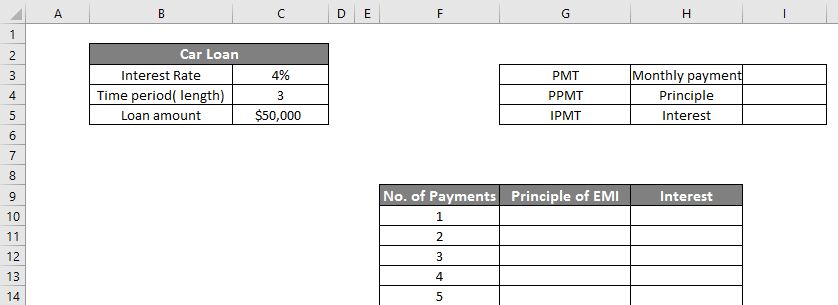

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

For instance 5125 could be.

. Last updated March 23 2022. There are two different ways you can repay your mortgage. There are many reasons you may want to give a cash gift to your loved ones.

Make sure you understand how much your seller can contribute based. 25-0000 Educational Instruction and Library Occupations. 8 Disclosures Sellers Must Make.

With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000. Even so 21 st Mortgage offers terms as far out as 23 years. Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2.

To calculate the amount of equity in your home review your mortgage amortization schedule to find out how much of your mortgage payments went toward paying down the principal of the loan. Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2. However as a drawback expect it to come with a much higher interest rate.

With a capital and interest option you pay off the loan as well as the interest on it. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure.

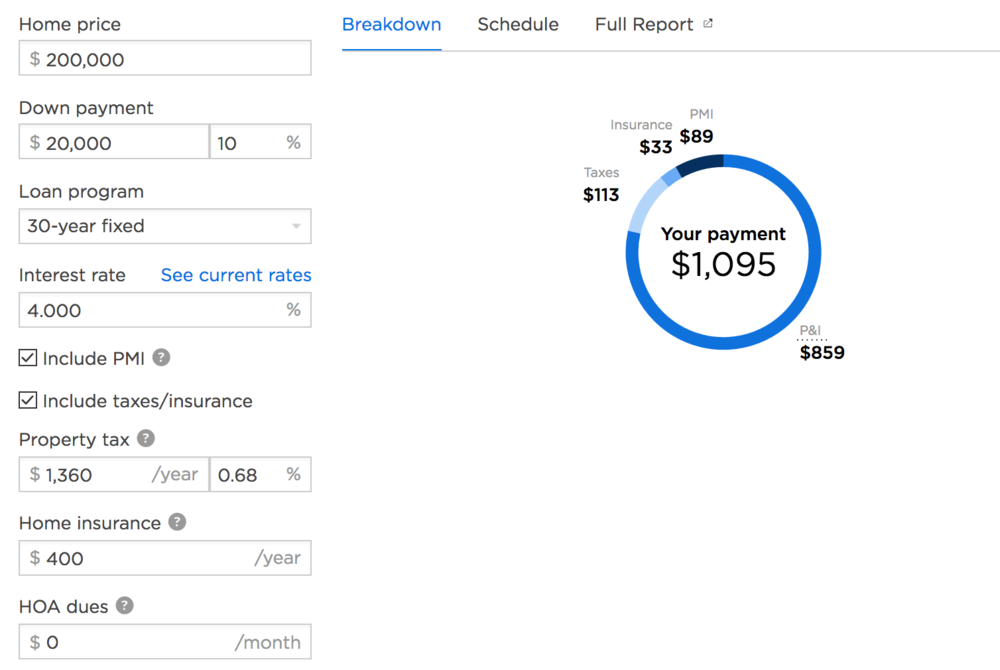

Your total monthly payment will fall somewhere slightly above a thousand dollars. The mortgage should be fully paid off by the end of the full mortgage term. August 19 2022 1125 AM CBS News.

This mortgage finances the entire propertys cost which makes an appealing option. Find out how much you can afford. Home buying with a 70K salary.

Exclusions and TCs Apply. Instead if you went on to make rental profits of 5000 in the 2022-23 tax year you could deduct your previous 2000 loss so youd only owe tax on rental profits of 3000. 80 More details.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Capital and interest or interest only.

Mortgage rates are based primarily on MBS and the structure of the MBS market can occasionally result in it being more profitable for a lender to offer a lower rate. Finally chattel loans often have lower closing costs and the time it takes to close on the loan is often much shorter. By Aly Yale Updated on.

How much mortgage can you afford based on your salary income and assets. Dog finds unique spot to keep an eye on her community. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

Understanding the Process of a Home Inspection. Heres what you need to know. And if you have a mortgage on the property you let out you can include some of the mortgage interest you incur as an expense.

If youre experiencing financial hardship due to the COVID-19 emergency you can request a temporary delay in mortgage payments. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Of course the exact value will vary depending on the loan term interest rate and lender.

31-0000 Healthcare Support Occupations. With an interest only mortgage you are not actually paying off any of the loan. Fannie Mae HomePath mortgage.

29-0000 Healthcare Practitioners and Technical Occupations. In this short video listen to what Veterans say what Home means to them. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances.

How Much Mortgage Can I Qualify for. The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment. What Is a Home Appraisal.

The piggyback second mortgage can also be financed through an 8020 loan structure. The two had been close friends since they met their first year at Columbia Business School. Variable 0 799.

The longer term will provide a more affordable monthly. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. They texted pretty much every day but Whitney had called to make a case for why her friend should fly up to New York City from Atlanta where she lived with her husband and teenage daughter to attend their 25th reunion.

This means that if you take out a mortgage worth 200000 you can expect closing costs to be about 4000 12000. Apple Watch Series 8 Review iPhone 14 Pro Pro Max Review Apple Watch SE 2022 Review iPhone 14 vs. How long will I live in this home.

Heres how you can secure the best possible mortgage rate in 2022. Fannie Mae HomePath mortgage. How much mortgage can I afford with a joint income of 50k.

23-0000 Legal Occupations. 27-0000 Arts Design Entertainment Sports and Media Occupations. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit.

It could be to help pay for a wedding a new car or university fees or to help give the younger generation a leg-up onto the property ladderOthers want to gift cash to reduce the value of their estate for inheritance tax IHT purposes with cash gift tax often being far less than the 40. Mortgage loan basics Basic concepts and legal regulation. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

FEATURED A NEW CASHBACK OFFER.

Dpacyzkdaocuum

Personal Monthly Budget Income Template Excel Monthly Budget Template How To Get A Fin Budget Planner Template Monthly Budget Template Monthly Budget Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

Pin On Agreement Template

23 Cover Letter Career Change Cover Letter For Resume Career Change Cover Letter Cover Letter Template

Free Buyout Agreement Form Printable Real Estate Forms Intervencion Transformacion Social Socialismo

Getting A Mortgage Is One Of The Biggest Financial Decisions You Ll Make In 2022 Financial Decisions Financial Advice Finance

Printable Mortgage Budget Planner How To Create A Mortgage Budget Planner Download This Printable Mor Budget Planner Template Budget Planner Budget Planning

Home Budget Template Budget Template Excel Budget Template Excel To Help You Managing Your O Home Budget Template Budget Template Household Budget Template

Mortage Montly Budget Template Budget Template Uk Making Own Budget Template Uk To Make A Clear Annual O Monthly Budget Template Budget Template Budgeting

Pin On Agreement Template

23 Cover Letter Career Change Cover Letter For Resume Career Change Cover Letter Cover Letter Template

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Event Room Agreement Template Pdf Free Download Room Rental Agreement Rental Agreement Templates Contract Template

Claire Kennedy Design Thai Fisherman Pants Thai Fisherman Pants Fisherman Pants Pants Pattern Free

Excel Mortgage Calculator How To Calculate Loan Payments In Excel